We used our database to examine the impact of the flat rate increase in the threshold for business rates for 2017 announced in the 2016 budget. The value of the boost to the London business property market completely outweighs the impact in the Northern Powerhouse cities.

In fact, the government spend on the support for offices in London exceeds by value its support for the Northern Powerhouse cities in Factories, Workshops, Warehouses, Offices and shops combined. Flat rate support continues to favour the capital at the expense of the country, undermining the potential for a Northern Powerhouse.

From April 2017, businesses occupying premises with a rateable value of £12,000 or less will be eligible for 100% relief. At present 100% rates relief is limited to properties with a rateable value of £6,000 or less. We used our database of Business Rates to identify the number of properties that would pay no business rates and to determine how, in England, this relief would be distributed.

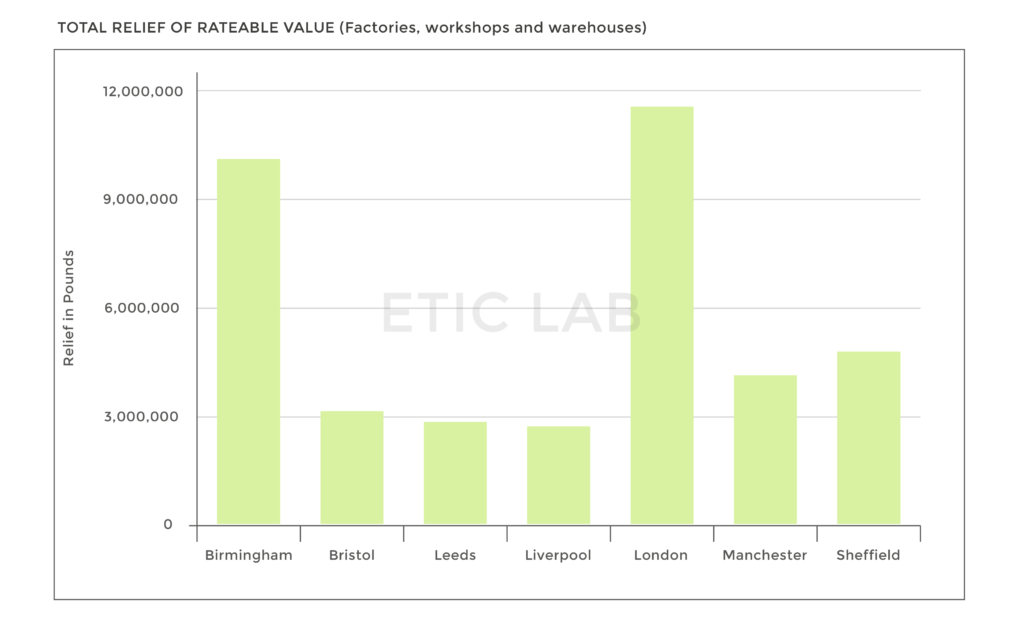

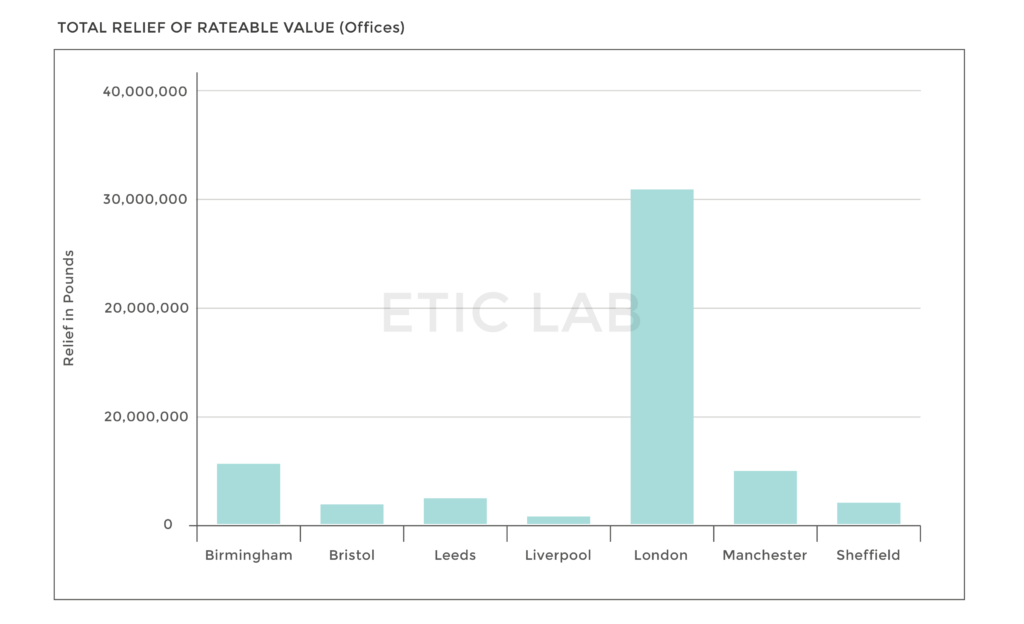

In carrying out this analysis we first identified all properties in the major English cities which are currently valued between £6,000, the present maximum value for 100% relief and £12,000 the new ceiling for 100% rates relief. We then examined how this would be distributed using the three major categories of rateable property occupied by small businesses – 1) Factories, workshops and warehouses. 2) Offices and 3) Shops.

The results of this analysis are expressed in terms of rateable value removed, not rates payable which are dependant upon the poundage in 2017 and number of other factors. The rateable value of the properties eligible for 100% rates relief does however clearly demonstrate the issues with this form of assistance and the relative level of support enjoyed by the major English cities.

It is clear that the primary beneficiary concerning Rates relief will be London in the Factories, workshops and warehouse category of business properties. Perhaps surprisingly, the relief for London in this category exceeds the so-called Northern Powerhouse cities in total.

When we look at the office sector, and the relative value of the amount of rates relief afforded to London based businesses becomes even more apparent. As might be expected, the level of rates relief in London dwarves the rest of the country in both relative and absolute terms. In fact, London receives more state support by way of increased relief on offices than the next seven largest cities combined. Indeed the level of support is also more than those seven cities receive in total for support of businesses located in factories, workshops and warehouses.

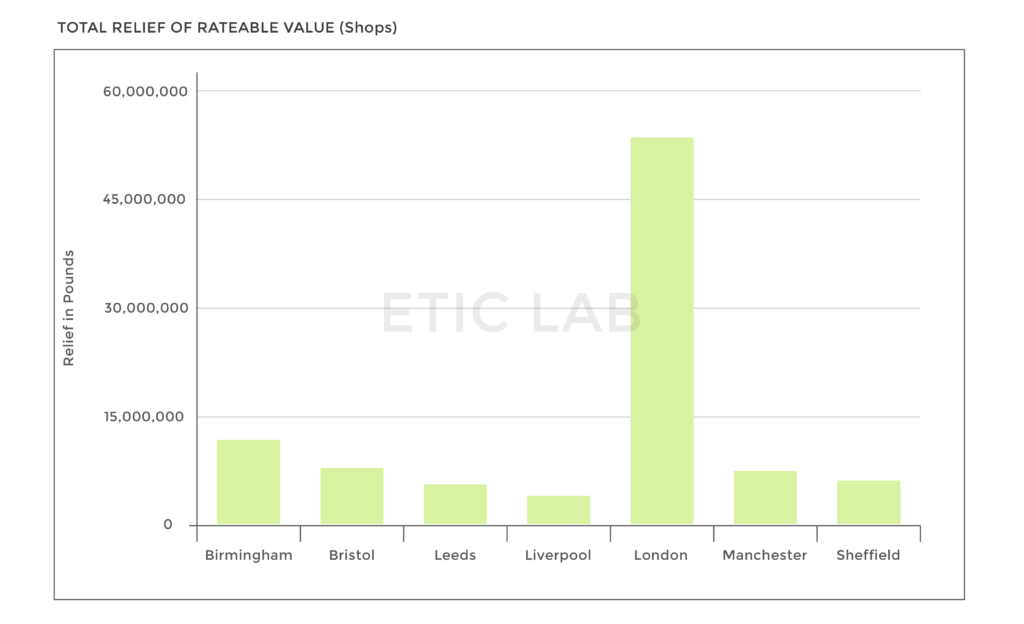

It is the shop’s sector of business rates subsidy arising from the 2016 budget that we can best see the impact of a flat rate approach to providing this support for business. The amount of revenue set aside to raise the rates threshold for those companies located in shops in London exceeds the total value of support for the next seven cities and their shop’s based businesses. In fact, the absolute level of rateable value removed from the business rates for London shops exceeds the entire support package offered to the next seven cities in total for factories, offices and shops, that is in all three categories combined.

If this is a level playing field, it is because the entire field is sloping towards London. It is undoubtedly tough to see any continuity here with the policy to recognise, encourage and support a Northern Powerhouse.

Or perhaps business rates relief isn’t seen as an appropriate vehicle to support small businesses – except the Chancellor says it is.

It is also reasonable to point out that the commercial property market in London’s the only part of England and Wales where property values have risen back to or exceed 2008 levels. Everywhere else market values for a commercial and industrial property have yet to return to 2008 values. A problem that this not only not addressed by the increase in business rates support but exacerbated.

London is favoured, almost absurdly, by the use of this method to provide support for small businesses. The full picture of this disproportionate benefit will not be fully known until the revaluation of business rates is completed and the new rates announced in 2017.

From our model, it would appear highly likely that the disparity of treatment will increase given that London rateable values will rise a good deal more than will be the case in the Northern Powerhouse cities or indeed the rest of England and Wales as a whole.