Business Confidence and Digital Signs

We introduce a new index of business confidence in the UK based upon the Digital Growth Index (DGI), a novel measure of on-line activity devised, implemented and tested by our sister company Network Praxis. As part of a larger programme of research and development we have developed a robust measure of the volume of digital behaviour designed for use at scale by our clients. This is the first public report of its application.

We want to show that we can reliably measure a significant business behaviour which reflects the degree of uncertainty experienced across the business community at any particular point in time. Numerous indices and surveys describe the level of confidence in various sectors of the business community and are widely published.

The intentions of purchasing managers are regularly canvassed for example and business confidence surveys of one stripe or another are published monthly or quarterly. We are all familiar with news outlets measuring the collective temperature of business sentiment by monitoring the impact of events upon market measures such as the FTSE and NYSE.

What we offer however, is a direct measure of the behaviour of individual businesses albeit on a very large scale. We have a sample data set collected every month and now reaching back more than five years. These data reflect the decisions made by thousands of ordinary businesses of all sectors and sizes. Decisions which we can show directly and rapidly represents the level of confidence in the business community as it responds to significant events occurring at the national level.

Our new data is not a measure of market sentiment which is itself a long way from the behaviour of individual businesses, nor is it a survey based upon a limited sample of people reporting their intentions. What we have created is a measure of what thousands of companies actually do every day and the extent and degree to which they stop or start doing at as a response to events. We offer a quantified behavioural metric that speaks to the inherently qualitative idea of business uncertainty.

Before describing what it is we measure, a few words on the concept of uncertainty. We began our research with a very specific understanding of uncertainty and used this to drive our approach to measuring it. We follow the view that information is that which reduces uncertainty. So for our purposes uncertainty is expressed directly as a practical difficulty in deciding what to do next. A situation that typically arises when the prior decisions to act are thrown into question by new information. So much so that alternative courses of action are not readily apparent and decisions previously made must be delayed or abandoned. We are measuring business uncertainty in the face of rapidly changing circumstances at the moment that it directly translates into the decision to delay or stop actions that would otherwise have occurred.

So what is it that we measure, what are the decisions that are affected by perceived uncertainty and how does this behaviour translate into a measurable behaviour?

The Internet is the largest source of public information in the world, millions of new items being added every day and it is this process which we observe. Just over 85% of UK companies with 10 or more employees operate a website(s) for the purpose of selling products and services, attracting investment or advertising their capabilities and achievements. Of the remainder most do not need or indeed do not want the exposure provided by a website.

Effectively, to a greater or lesser degree, almost all registered UK companies now maintain a website. What this means in practice is that every week tens of thousands of companies here in the UK undertake maintenance; repairing, tidying and extending web properties. This activity takes place in public and can with suitable tools be observed at scale. Our company has developed a range of tools for acquiring, cataloguing and measuring these activities. Building upon this capacity we have built and tested a number of algorithms to help us create new and entirely novel measures of business behaviour, one of which we call the Digital Growth Index (DGI).

The Digital Growth Index is a measure of the rate and scale of the work undertaken by companies when they periodically make changes to their web properties. Although designed to support a business intelligence and investment function, this metric when applied at a sufficiently large scale serves to show the impact of changes in business certainty over time for the country as a whole.

We have been able to show how our DGI metric changes in response to major events, expressing as a number how, in aggregate, many thousands of businesses react to these events. We count the sum of their decisions and when they delay, downgrade or stop work on their websites it becomes clearly visible. This is only possible because we constantly monitor a very large group of company websites selected to represent the wider economy. For the work reported in this Blog we used a dataset drawn from the behaviour of 48,000 companies over the last five years, chosen and weighted to represent the regions of England and Wales as closely as possible.

What we have found out about company behaviour in isolation and aggregate cannot be covered in a blog, but if you are interested in understanding our measures of the business economy a more detailed introduction is available elsewhere. What we now know is that we can characterise and explore the different strategies and practices typically followed by companies with respect to their digital presence. Network Praxis has a large body of data concerning the impact and distribution of innovation, growth in the visibility of environmental concerns, exporting and technology developments reflected in our new metrics. Not to mention the big drivers influencing all of our digital measures; the impact of competitive pressure, B2B versus B2C strategies and business confidence/growth.

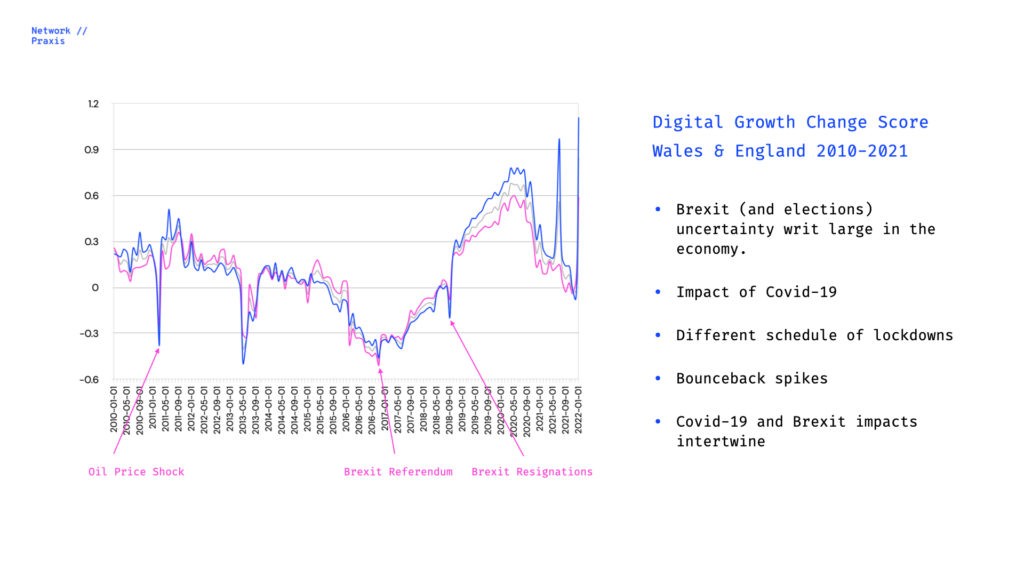

But what we find especially interesting and want to highlight here, is the fact that the Digital Growth Index reflects the impact of the turmoil in British politics around Brexit so closely. In fact looking back even further we have been able to detect, as you might expect, national elections through their impact upon business confidence as measured by (DGI) over the last 12 years. But looking back over the last five years in our data shows that even the decision to hold a referendum on Britain’s membership of the EU impacted our metric, as did the vote itself, the failure of Teresa May to secure support for the first version of the deal and subsequent events. In fact these events can be seen to be occur alongside the most significant changes in our Digital Growth Index – ever.

Now of course, we also have two years data covering the period of the Covid-19 pandemic and its impact upon business confidence which, if anything has been even more dramatic as seen through the lens of the DGI. We can see how the impact of Brexit and Covid-19 now intertwine insofar as the post Brexit leap (bounce-back) in activity came to a crashing halt as lockdown commenced and subsequent openings and closings are represented in the data. In fact so too is the impact of different lockdown schedules in England and Wales reflected in the DGI for these two countries. Right now we can see that what we are calling a bounce-back after the last lockdown is underway. In fact we have more recent data suggesting a further twist to this tale.

We have begun to use the DGI and the other measures that make up the ForesightSI product developed over the last three years to explore a whole host of topics such as the distribution of Innovation in SME’s and the relationship between investment in Digital on-line tooling and company sustainability. Apart from research we have several powerful commercial applications supported by our SaaS platform of which the DGI forms a small part.

So far at least one of the most intriguing findings is that a day of resignations from Theresa Mays’ cabinet back in the autumn of 2019 reduced the commercial activity underpinning the maintenance of UK Ltd’s websites by such a margin as to stand out in the record going back more than a decade. Uncertainty, real and impactful disruption to the plans of UK business now has a number. We only wish that our new tool had arrived at a time when events might not so clearly be seen to driving the measure so dramatically.